The billion-dollar block

Stripe didn't buy Metronome to grow. They bought it to keep OpenAI out of billing.

OUR BIG STORIES THIS WEEK

Stripe’s defensive acquisition is blocking OpenAI from billing

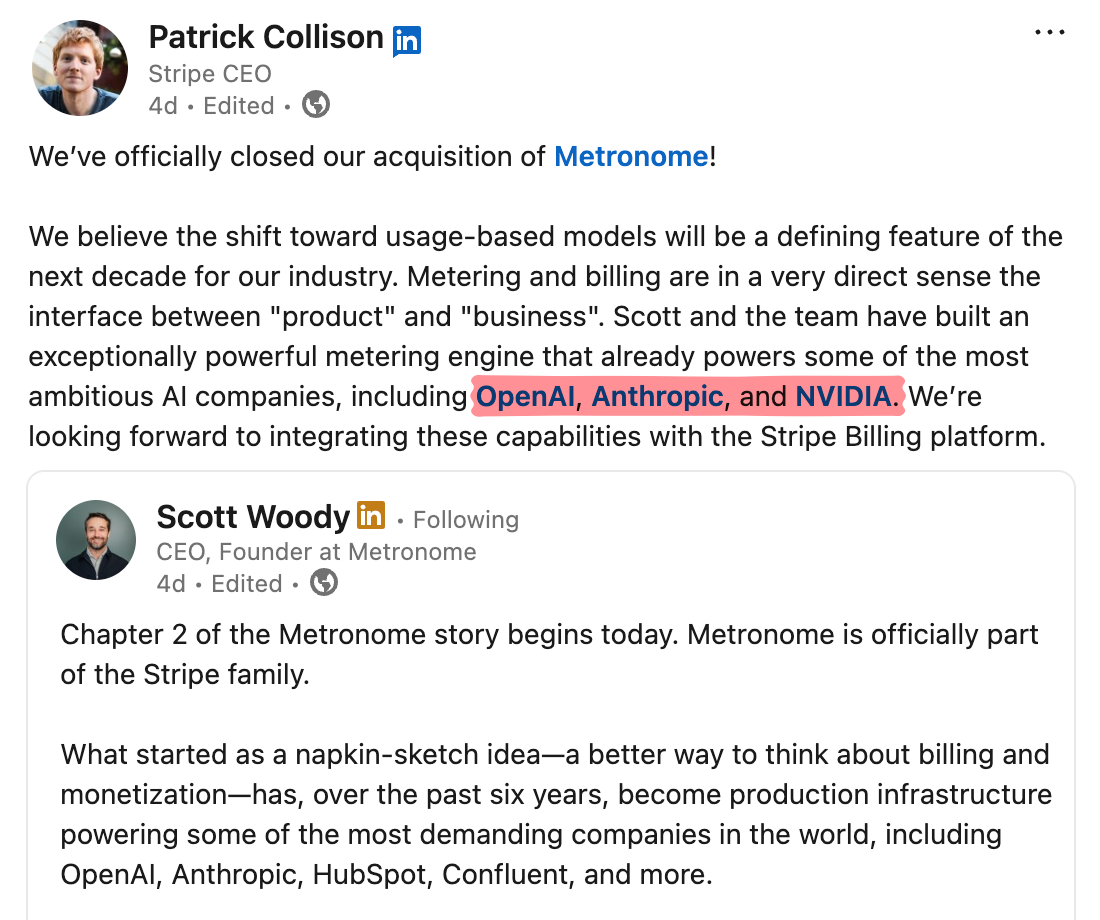

The Stripe-Metronome deal officially closed this week (Jan 14). Patrick Collison announced a billion-dollar acquisition of “an exceptionally powerful metering engine that already powers OpenAI, Anthropic, and NVIDIA.”

Read that customer list again please - OpenAI, Anthropic, and NVIDIA.

While some say that Stripe needed usage-based billing capabilities, The bird has a different theory: Stripe bought Metronome to block OpenAI from buying it first.

OpenAI is quite likely Metronome’s largest customer by revenue and volume. Their entire API business runs on usage-based billing, tokens in, tokens out. Billing infrastructure is existential for them.

If OpenAI were to, say, acquire Metronome, they wouldn’t just be an AI company anymore. They’d be a billing competitor - with lots of distribution.

With enterprise relationships.

With the technical credibility that comes from their own massive-scale metering.

Stripe saw this threat, and for them a billion dollars is cheap insurance against a new titan entering your market with unlimited capital and a potential grudge against their card processing fees.

The consequence and opportunity is that OpenAI is now perhaps a bit too reliant on a strategic frenemy. Their billing infrastructure runs on a system owned by a company that competes for the same enterprise relationships.

The Bird’s prediction: OpenAI will build their own billing infrastructure in-house sooner rather than later. They cannot afford to have their monetisation layer owned by someone else’s platform. The Bird expects to see hiring of billing engineers in the next 2-4 months.

Orb, Amberflo, and the rest are now competing against Stripe’s distribution machine and racing against OpenAI’s inevitable build-vs-buy decision.

THE MCP CIRCUS: Everyone’s got one, nobody knows why

Last week we covered Dodo Payments’ ContextMCP. This week Zuora’s MCP and Maxio MCP both went live.

Three MCP announcements in two weeks - the billing industry has discovered Model Context Protocol a few months after it peaked.

The Bird has questions though - specifically: does anyone actually need this?

A couple of months ago, Anthropic published some posts casting shadows on MCP’s future. With Skills now common-place, MCP might be solving a problem that no longer exists.

The criticism, as articulated by developers like theo goes like this:

MCP was created because LLMs were bad at writing code to API specs

LLMs are now good at writing code to API specs

Anthropic’s proposed fix for MCP’s problems is having the LLM write code to a generated spec

So why not just use the original API specs that humans already use?

We’ve gone full circle. We started with OpenAPI specs, abandoned them for MCP because LLMs couldn’t handle them, and now that LLMs can handle specs, we’re generating specs from MCP to have LLMs write code against them.

Zuora’s MCP promises developers can “build quote-to-cash integrations in minutes instead of days”, while Maxio’s MCP offers “governed AI access to financial data”. Both sound dull and impressive simultaneously until you ask why is this even necessary.

Funnily enough, Zuora’s post includes a video showing how Windsurf is used. Seriously - who even uses Windsurf and not Claude Code or Cursor? Out of touch with reality!

The Bird’s verdict: MCPs are checkbox features for vendor marketing decks. The actual utility is questionable, the token costs are real, and the risk model is undefined. Claude Skills (meaning, markdown files that explain how to call API) might be the more future-proof AI-native approach, but that’s far less impressive on a feature comparison slide.

✨SHINY OBJECTS

LAGO’S AI AGENT ARMY: Chasing the narrative

Lago’s CEO announced they’ve built three AI agents:

Billing Assistant: Process billing tasks via plain language

Finance Assistant: Generate invoices, reports, compliance answers without engineering inputs

Pricing Assistant: Simulate pricing models against real usage data before launch

The roadmap promises revenue predictions, churn modelling, and automatic user segmentation.

Also buried in Lago’s news: PayPal joined their customer roster alongside CoreWeave, Mistral, Groq, and Synthesia.

Zuora’s Pricing Waterfall View

Their pitch: “View the step-by-step breakdown of how a final price is derived” for dynamic pricing.

The mechanic: Displays each layer - from base price, dynamic price (segment-based, attribute-based, negotiated), formula-based adjustments, discounts. Finally, you can see why a price is what it is.

The Bird’s verdict: This is actually useful. When your pricing logic has seventeen layers and nobody remembers why that enterprise customer gets 23.7% off, a waterfall view is a torch aimed at the logic. Surprisingly decent!

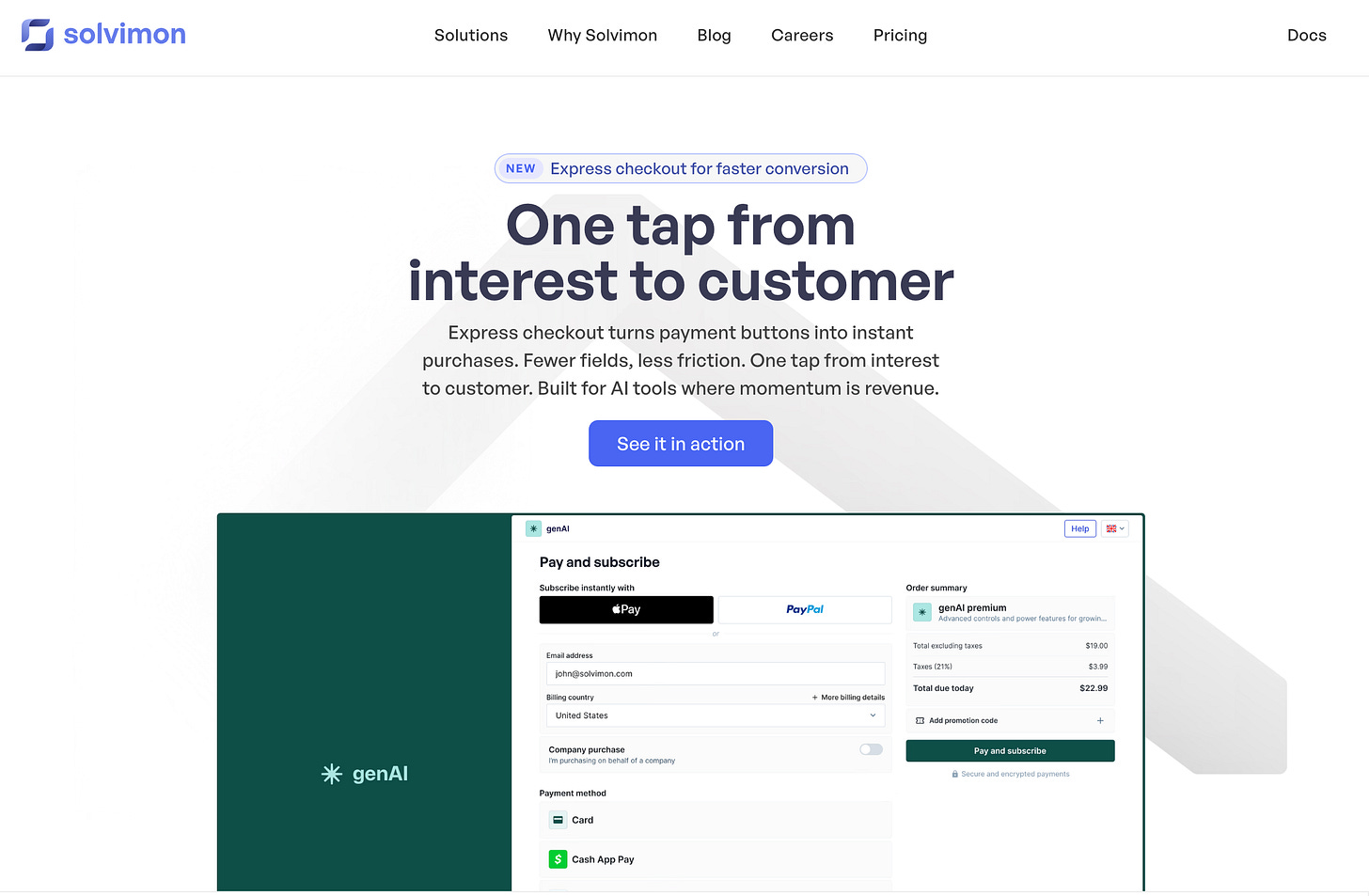

Solvimon Express Checkout with Apple Pay

Their pitch: “Your user taps Pay, and Solvimon handles billing address + tax calculation + account creation in one transaction.”

The mechanic: Single-tap conversion for AI and B2C products. Seven seconds from intent to upgrade. No form-filling. No friction.

The Bird’s verdict: This isn’t a payment feature. This is identity ingestion. For PLG and B2C, the signup form is the enemy. If you can skip it entirely and create the account on the payment event, you’ve removed the biggest conversion killer. Clever.

Zoho’s UAE Data Centres

Their pitch: Dubai and Abu Dhabi facilities, AED 100 million investment, 100+ cloud solutions hosted locally.

The mechanic: After every possible certification, now looking at data sovereignty for government compliance.

The Bird’s verdict: Not everything should be stored in us-east-1. If you need data residency in the UAE, Zoho just became viable.

Regional play, executed properly.

😶 THE SILENT TREATMENT

Chargebee, Paddle, Younium, Amberflo, LedgerUp, Alguna, Paid, Autumn, Polar, Frisbii, UniBee — all quiet.

No launches. No hires. No drama.

Chargebee’s silence is particularly loud. The market is moving, AI features are everywhere, Stripe just absorbed a competitor, and they’re... absent. Either they’re cooking something substantial or they’re hoping nobody notices them standing still.

🦅 MIGRATION PATTERNS

No major exec moves this week. Is the industry is holding its breath post-acquisition of Metronome?

Keeping our eyes out for exits and engineering leads jumping to Open AI.

The feathers will ruffle soon.

🏆 THE MOST BORING UPDATE AWARD

Maxio: Great Place to Work (Poland Edition)

Following last week’s Atlanta recognition, Maxio Poland is now certified as Great Place to Work 2026-2027 for Poland too.

Seriously, we’re genuinely happy for the Polish team. But now ship something that matters.

Our final word this week

Somewhere, an OpenAI finance lead is quietly building a business case for in-house billing infrastructure. OpenAI now runs their entire monetisation stack on infrastructure owned by a strategic frenemy. That’s an uncomfortable dependency for a company valued at >$500 billion last time The Bird looked.

Meanwhile, the MCP circus continues. Three billing vendors shipped MCP integrations this month, and the developer community is increasingly asking why MCP exists at all when LLMs can just write code to existing API specs. Anthropic’s own proposed fix for MCP’s problems is essentially “have the LLM write code” — which rather defeats the purpose of having MCP in the first place.

Welcome to 2026.

— The Billing Bird